Compound Interest

Money growing on top of both the original amount and previously earned interest, like a snowball getting bigger as it rolls. 💰

Brief Introduction

Compound interest is when you earn money not just on your initial savings, but also on the interest you've already earned. It's like having a money-making machine that gets more powerful over time. This is how many people grow their wealth through savings accounts, investments, and retirement funds. 🌱

Main Explanation

Interest on Interest 🔄

Unlike simple interest that only grows from the original amount, compound interest creates earnings on both your initial money and accumulated interest. It's like a tree that grows new branches, and then those branches grow their own smaller branches.

Time is Your Friend ⏳

The longer you leave your money to compound, the faster it grows. It's like a domino effect that gets bigger over time. The growth starts slow but accelerates as time passes, which is why starting early is so important.

Frequency Matters 📅

Interest can compound daily, monthly, or yearly. The more frequent the compounding, the more money you earn. It's like watering a plant - the more regularly you water it, the better it grows.

The Rule of 72 📊

A quick way to estimate how long it takes money to double: divide 72 by the interest rate. For example, at 6% interest, money doubles in approximately 12 years (72÷6=12).

Examples

- If you put $100 in a savings account with 10% annual compound interest, after one year you'll have $110. The next year, you'll earn interest on $110, not just the original $100, giving you $121. 💵

- Think of a small snowball rolling down a snowy hill. As it rolls, it picks up more snow, getting bigger, which then helps it pick up even more snow - that's compound interest in action! ⛄

- Plant two trees: one in your backyard, one in your friend's. Your friend cuts their tree's new branches yearly (simple interest), while you let yours grow naturally (compound interest). After several years, your tree will be much larger because each new branch supported the growth of more branches. 🌳

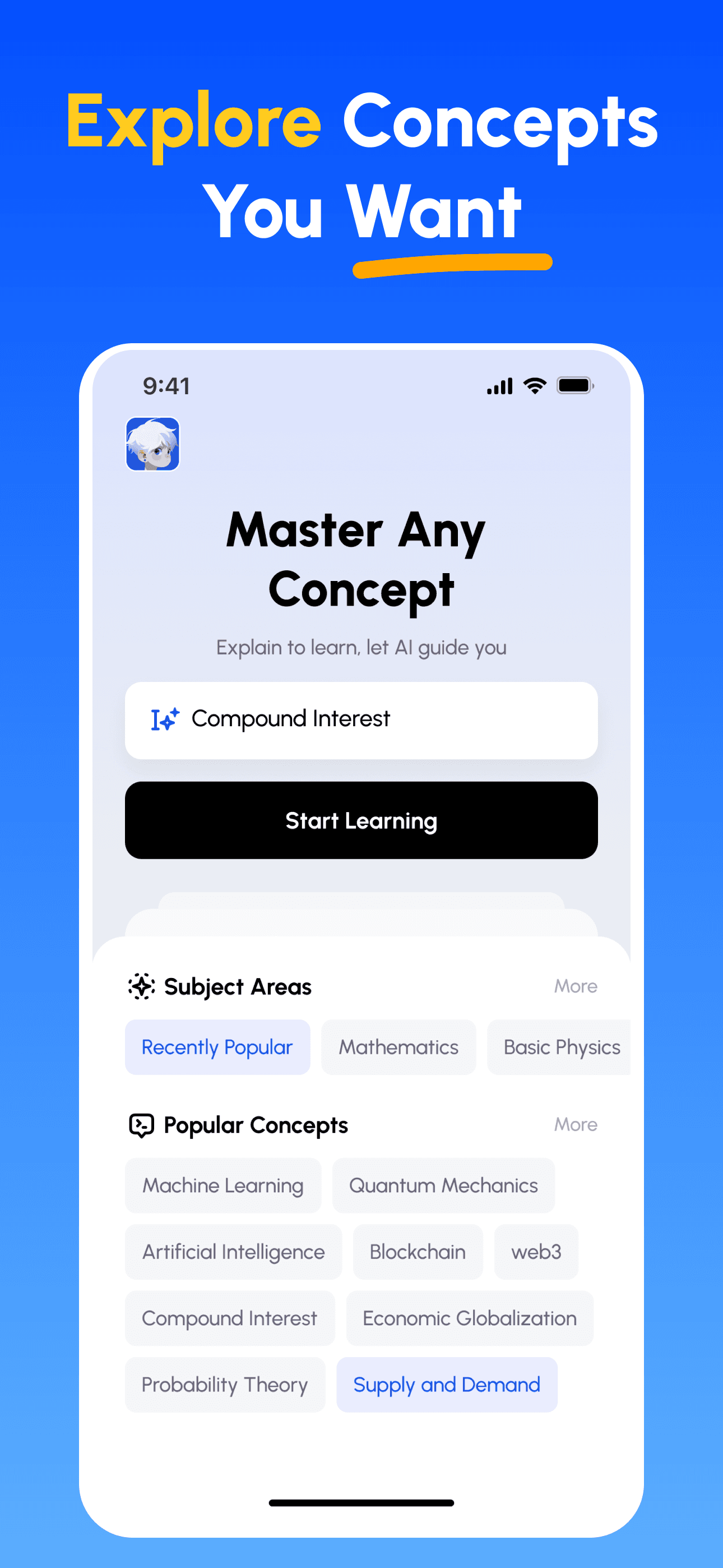

How Feynman AI Guides Your Learning

- Choose Any Concept: Start from a topic you want to master — browse curated subjects or enter your own.

- Learn Essentials: Skim clear, structured explanations, key terms and common pitfalls to form a solid mental model.

- Explain & Get Feedback: Record your explanation (voice or text). Get instant analysis on depth, clarity, structure and example quality.

- Review Scores & Improve: Follow targeted tips, refine your explanation and iterate until you can teach it simply.

Download Feynman AI Now

Start your learning journey today!